7 Key Insights on What Makes a Good Rental Property

What makes a good rental property? That question matters more than ever. With rising housing costs, tighter lending, and growing tenant expectations, investors need to be strategic. Picking the right property can mean steady income, tax advantages, and long-term wealth. But choosing the wrong one? That can drain your time, money, and patience.

In this guide, we’re breaking down seven critical insights every investor should understand before buying a rental. These aren’t just theories — they’re practical, real-world factors that influence cash flow, tenant satisfaction, and long-term returns.

Importance of Rental Properties

Rental properties continue to be one of the most powerful paths to financial independence. Unlike stocks or crypto, real estate gives you a physical asset with multiple ways to build wealth — cash flow, appreciation, tax benefits, and leverage.

Here’s why rentals remain a go-to for investors:

Cash flow: Monthly rent income that covers expenses and ideally puts money in your pocket.

Equity growth: As tenants pay down your mortgage, your ownership stake increases.

Appreciation: Over time, property values tend to rise — especially in high-demand markets.

Tax advantages: Depreciation, mortgage interest, and expense deductions can lower your tax burden.

Control: You choose the property, the financing, the management, and the exit strategy.

But not all rentals are created equal. Buying a good property is more than picking something in your price range. You need to analyze every angle: the location, the condition, the numbers, and the people it’ll attract.

Overview of Key Insights

The seven key insights to what makes a good rental property:

Location matters — more than almost anything else.

The property's condition affects everything from rent price to repairs.

Positive cash flow is non-negotiable.

Good tenants don’t just show up — you need a strategy to keep them.

Property management is either your best asset or biggest liability.

Investment strategies should evolve with your portfolio and the market.

Long-term success means knowing when to take action — and when to wait.

Let’s start with the one factor you can’t change after you buy: the location.

1. Location Matters

Assessing Neighborhood Quality

A great rental property requires due diligence to make sure the area will support the investment. The quality of the surrounding area directly affects rentability, tenant quality, and property value.

Here’s what to research before buying:

Crime statistics – Use city or state crime maps.

School ratings – GreatSchools.org is a helpful resource, even if your tenants don’t have kids.

Job opportunities – Areas near major employers or universities tend to have strong rental demand.

Owner-to-renter ratio – A balanced mix is usually best.

Local economy – Is the population growing? Are businesses opening or closing?

Drive the area during the day and at night. Look at the condition of other homes, sidewalks, and streets. If something feels off, don’t ignore it.

Proximity to Amenities

Renters look for convenience. That includes access to:

Grocery stores

Public transportation

Parks and green space

Hospitals or urgent care

Schools

Coffee shops and restaurants

Even something like a nearby dog park or gym can make your listing more attractive and help justify higher rent.

Future Development Plans

Look ahead, not just at what’s there now. A property near a soon-to-be-built highway exit, shopping center, or Amazon fulfillment center could skyrocket in value.

Check city planning websites or call the zoning department to learn about:

New commercial projects

Transit expansions

Public infrastructure updates

School construction or district changes

But be mindful: not all development is good. A massive new apartment complex down the street might mean future competition.

2. Property Condition and Upkeep

Importance of Maintenance

Properties that seem like a “great deal” often hide costly surprises. A roof that’s about to fail or plumbing from the 1950s can quickly erase any potential profit.

Before buying, schedule a full inspection. Pay attention to:

Roof age and material

HVAC system condition

Electrical and plumbing systems

Foundation cracks or water intrusion

Windows and insulation (especially in colder climates)

Minor cosmetic fixes like paint or flooring are fine. But steer clear of major structural issues unless you're a pro or budgeting for a big rehab when you are looking for what makes a good rental property.

Renovations That Add Value

Focus on upgrades that tenants care about:

Modern kitchens – Stainless steel appliances, updated cabinets, and good lighting.

Bathroom updates – Clean grout, working exhaust fans, and decent fixtures go a long way.

Flooring – Durable vinyl plank is often better than carpet.

Curb appeal – Fresh landscaping, paint, and a clean exterior make the property more welcoming.

Energy efficiency – LED lights, smart thermostats, and weatherproofing help lower tenant utility costs (and improve satisfaction).

Remember, you’re not designing your dream home. Keep it simple, functional, and low maintenance.

3. Rental Property Cash Flow Analysis

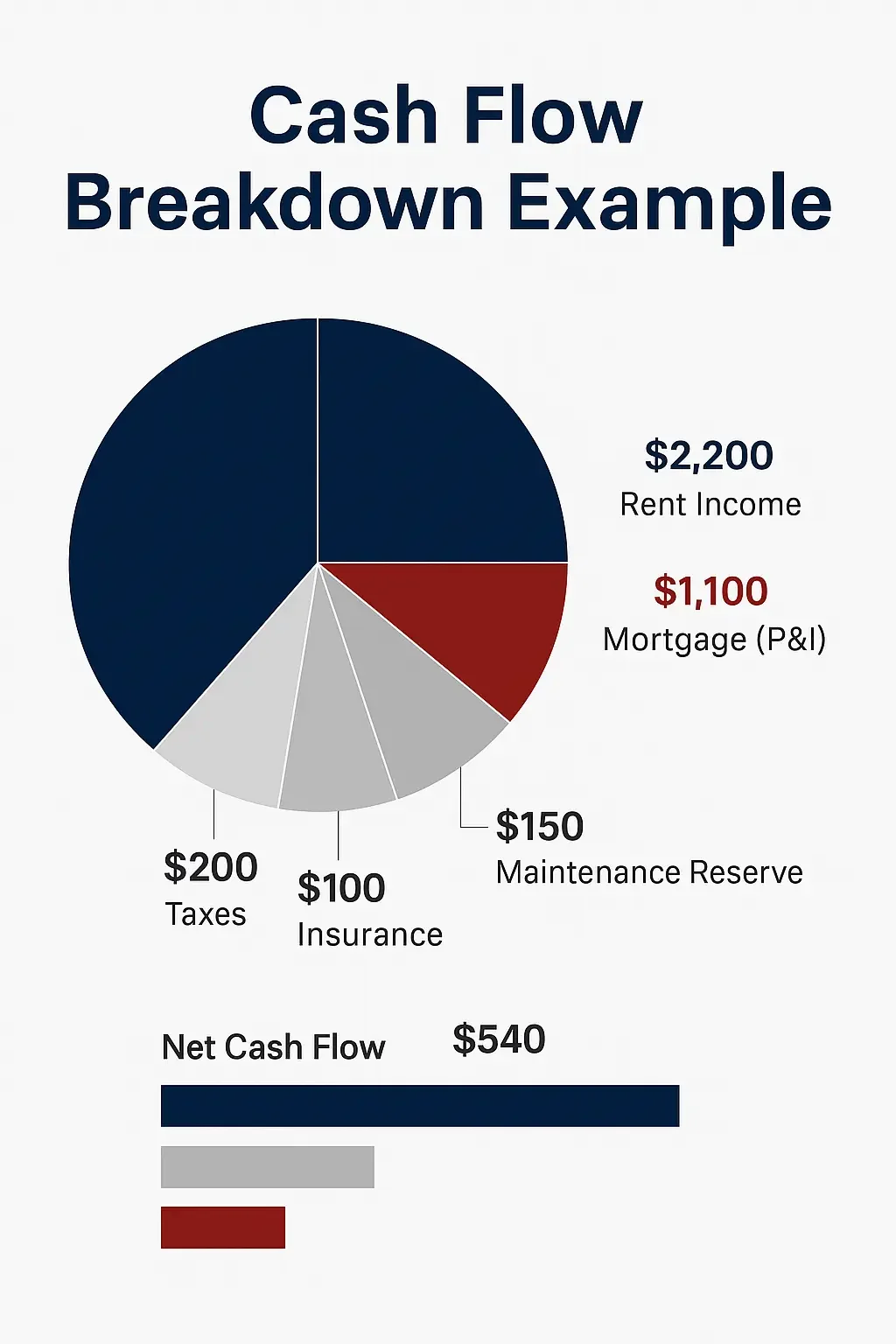

Understanding Cash Flow

Cash flow is the money left over after all expenses are paid. Positive cash flow is critical — it keeps your investment sustainable, even when things go wrong.

To calculate it, subtract your monthly expenses from your rental income:

Rent – (Mortgage + Taxes + Insurance + Maintenance + Management + Vacancy)

For example:

Rent: $2,200/month

Mortgage (P&I): $1,100

Taxes: $200

Insurance: $100

Maintenance reserve: $150

Management fee: $200

Vacancy reserve (5%): $110

Net Cash Flow = $340/month

Expenses vs. Income

Be conservative with your estimates:

Assume 5–10% vacancy

Budget at least 10% for maintenance

Include property management, even if you plan to self-manage — your time has value

Don’t forget capital expenditures (CapEx), like roofs or HVAC replacements every 10–15 years

If your deal only works when everything goes perfectly, it’s not a good deal.

Importance of Positive Cash Flow

Cash flow isn’t optional. It protects you from unexpected costs, gives you the ability to reinvest, and provides a true income stream — not just equity on paper.

Even small positive cash flow (like $200–$300/month) can add up across multiple properties.

4. Tenant Retention Strategies

Building Relationships with Tenants

Good tenants are worth keeping. Every time someone moves out, you lose rent and spend money on turnover.

Simple ways to build trust:

Respond to maintenance requests quickly

Send annual thank-you notes or check-ins

Offer online rent payment options

Be fair and transparent about lease terms

People stay longer where they feel respected and taken care of.

Creating a Welcoming Environment

Set the tone from the beginning. Before move-in, make sure the unit is:

Professionally cleaned

Functioning properly (no burnt-out bulbs, working outlets, etc.)

Stocked with small touches (batteries, trash bags, a welcome letter)

Even leaving a $10 coffee gift card can turn a good first impression into a great one.

Incentives for Long-Term Tenants

Retention saves money, period. Consider:

Rent discounts for multi-year leases

Free carpet cleaning or upgrades after the first year

Priority on maintenance requests

Annual lease renewal gifts or thank-yous

A little generosity keeps great tenants in place.

5. Effective Property Management Best Practices

Hiring the Right Property Manager

Not all investors want to self-manage, especially if they live out of state. A great property manager can be the difference between success and stress.

Ask these questions:

How do you screen tenants?

What’s your process for late rent or evictions?

Do you handle maintenance in-house or outsource it?

What’s your average response time to tenant issues?

Fees usually range from 8%–12% of rent collected, plus leasing fees.

Communication and Transparency

You should receive:

Monthly income/expense statements

Copies of repair receipts

Regular updates on tenant concerns

Notification before big expenses or legal issues

Don’t let a bad manager slowly eat away at your profits.

Regular Maintenance Protocols

Build a preventative maintenance schedule:

HVAC serviced every spring/fall

Gutters cleaned 1–2x/year

Annual pest inspection

Water heater flushed yearly

This saves money and keeps your property in top shape.

6. Investment Strategies for Success

Evaluating Market Trends

Don’t just buy in the city you live in. Look for:

Population growth

Rent growth and occupancy rates

Strong job markets (tech, healthcare, logistics, etc.)

Landlord-friendly regulations

Resources like Roofstock, Mashvisor, and Rentometer help compare different markets across the country.

Diversifying Your Portfolio

Once your first property is running smoothly, consider expanding. You can diversify by:

Geography (invest in different cities/states)

Property type (SFH, duplex, small multi-family)

Rental strategy (long-term vs. short-term)

Tenant base (working professionals vs. students vs. retirees)

Diversification reduces your risk exposure to any single market or event.

Long-Term vs. Short-Term Rentals

Long-term rentals:

More predictable income

Less turnover

Lower management fees

Short-term rentals (Airbnb, VRBO):

Higher nightly rates

Potentially higher annual returns

– Requires frequent cleaning, furniture, and dynamic pricing

– Risk of regulation changes

Know your strengths and choose a strategy that fits your time, budget, and local laws.

Conclusion

Let’s review what makes a good rental property:

It’s in a strong, convenient location

It’s structurally sound and attractively maintained

It generates consistent positive cash flow

It appeals to and retains responsible tenants

It’s either managed well by you—or someone you trust

It aligns with your long-term investment strategy

Smart investors don’t rush. They run the numbers, research the market, and stay focused on the long game.

FAQ

-

Location, modern updates, reasonable rent, and access to amenities. Tenants want safe, convenient, and clean homes.

-

It cash flows after all expenses, is in a growing area, and doesn’t need major repairs. Bonus points if it has strong appreciation potential.

-

Respect, quick maintenance responses, small gestures of appreciation, and fair lease terms all matter more than you think.

Taking Action for Success

You don’t need to be an expert to invest in rentals—but you do need a plan. Use the insights in this post to what makes a good rental property make smarter decisions, whether you're buying your first property or scaling up your portfolio.

Want help analyzing a specific property? Or need tools to run the numbers? Just ask.